Let me share a revelation that transformed my entire relationship with money. Three years ago, I was making $85,000 annually but feeling constantly guilty about every purchase. Then I discovered value-based spending, and everything changed. Within six months, I was saving more money while actually enjoying my purchases more.

The problem wasn’t how much I was spending – it was that my spending didn’t align with what truly mattered to me. VB spending isn’t just another budgeting method; it’s a complete shift in how we think about and use money.

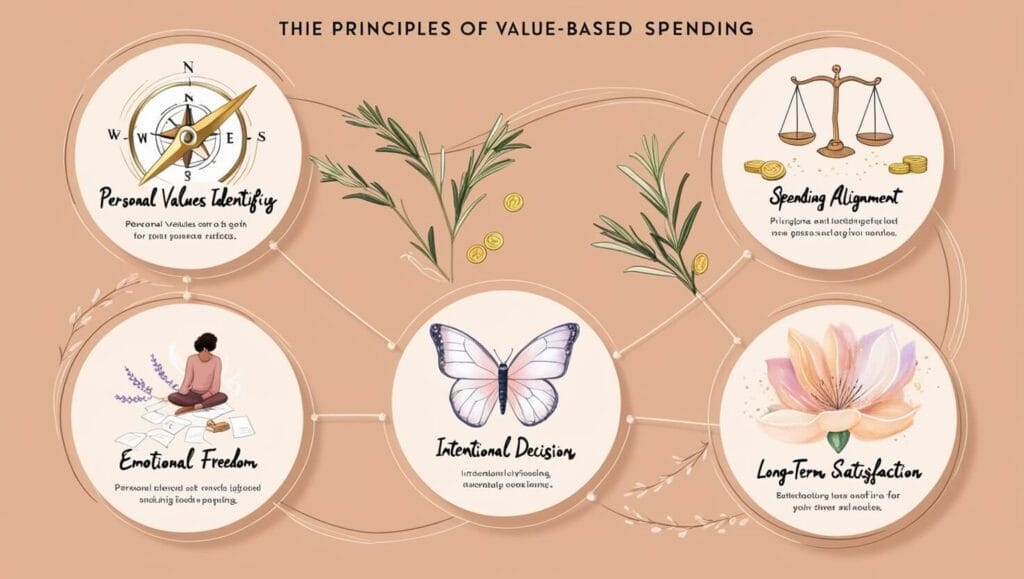

The Five Principles of Value-Based Spending

After helping hundreds of clients implement value-based spending, I’ve identified five core principles that make this approach so effective:

1. Personal Values Identification

Before you can implement value-based spending, you need to clearly understand what matters most to you. This goes beyond generic categories like “family” or “health” – it requires deep reflection on what brings genuine fulfillment.

2. Spending Alignment

Value-based spending requires regular evaluation of whether your purchases reflect your stated values. When I first did this exercise, I was shocked to find I was spending more on social media subscriptions than on my passion for hiking.

3. Intentional Decision Making

Value-based spending eliminates impulsive purchases by creating a framework for thoughtful spending decisions. Every purchase becomes an opportunity to invest in what matters most to you.

4. Emotional Freedom

The most powerful aspect of value-based spending is the elimination of spending guilt. When your purchases align with your values, you experience what I call “financial peace” – the ability to spend money without second-guessing every decision.

5. Long-term Satisfaction

Through value-based spending, I’ve discovered that purchases aligned with our values provide lasting satisfaction, unlike the temporary high of impulse buying. This principle has helped me and countless clients build healthier relationships with money.

Value-Based Spending

At its core, value-based spending means aligning every financial decision with your personal values and life priorities. Unlike traditional budgeting that focuses on restriction, VB spending emphasizes intentional choices that bring genuine satisfaction.

Through implementing VB spending in my own life, I discovered that nearly 40% of my previous purchases didn’t align with what I truly valued. This awareness alone helped me redirect thousands of dollars toward things that actually improved my life.

Implementing Value-Based Spending in Daily Life

Let me share the exact process that helped me transition to value-based spending. The journey begins with a simple but powerful exercise: the Value-Money Audit.

First Step: Value Identification Take time to identify your top five life values. Mine were:

- Personal growth and learning

- Health and wellness

- Meaningful relationships

- Creative expression

- Financial security

Second Step: Spending Analysis Review your last three months of spending through the lens of value-based spending. Categorize each expense as:

- Directly supports values

- Indirectly supports values

- Doesn’t support values

When I first did this value-based spending analysis, I discovered that 45% of my discretionary spending didn’t align with my stated values. This eye-opening realization led to immediate changes in my spending habits.

Creating Your Value-Based Spending Plan

The key to successful value-based spending is creating a structured approach that’s both flexible and sustainable. Here’s the framework I use with clients:

Monthly Planning Process: Start each month by reviewing your values and setting specific spending intentions. VB spending requires this regular check-in to stay aligned with what matters most.

Weekly Review: Take 15 minutes each week to ensure your spending aligns with your values. This regular practice strengthens your VB spending muscles and prevents drift from your priorities.

Daily Decisions: Before making any purchase over $50, ask yourself these value-based spending questions:

- Does this purchase align with my core values?

- Will this bring lasting satisfaction?

- Am I buying this for the right reasons?

- Could this money better serve my values elsewhere?

Common Challenges in Value-Based Spending

Even with clear values, implementing VB spending can face obstacles. Here are the most common challenges I’ve encountered and their solutions:

Social Pressure: Many clients struggle when their value-based spending decisions don’t align with social expectations. The solution lies in confident communication about your choices and finding like-minded people who respect your approach.

Conflicting Values: Sometimes different values seem to compete for our resources. VB spending helps resolve these conflicts by encouraging us to prioritize what matters most in each situation.

Value-Based Spending in Relationships

One of the most challenging aspects of value-based spending arises in relationships. When partners have different values, financial decisions can become contentious. Through implementing value-based spending with couples, I’ve developed a framework that works consistently.

Start with Individual Values: Each partner independently identifies their core values and ideal spending patterns. This creates a foundation for understanding each other’s perspectives through the lens of VB spending.

Find Common Ground: Look for overlapping values and shared priorities. Even when values differ, VB spending can help couples find creative solutions that honor both partners’ priorities.

Create Shared and Individual Spaces: Successful couples often maintain both joint and personal accounts, allowing for VB spending that reflects both shared and individual values.

Real-World Success Stories

Let me share three transformative examples of value-based spending in action:

Sarah’s Story: A client who transformed her $65,000 salary into a life she loves through VB spending. By aligning her spending with her true values, she:

- Eliminated $15,000 in unnecessary annual expenses

- Started a passion project business

- Improved her relationship with money

- Built an emergency fund

- Increased her overall life satisfaction

Michael’s Journey: A high-earning professional who felt constantly stressed about money until implementing value-based spending. His results after six months:

- Reduced spending by 35% without feeling deprived

- Redirected money to meaningful experiences

- Improved family relationships

- Enhanced career satisfaction

- Achieved better work-life balance

The Long-Term Impact of Value-Based Spending

The true power of VB spending reveals itself over time. After two years of consistent practice, I’ve observed these lasting benefits:

Financial Peace: When your spending aligns with your values, financial anxiety diminishes naturally. Value-based spending creates a sense of purpose in your financial life.

Better Decision Making: VB spending improves not just financial choices but overall life decisions. The clarity it brings extends beyond money management.

Enhanced Life Satisfaction: By focusing resources on what truly matters, VB spending leads to greater fulfillment and life satisfaction.

Implementation Strategy

Ready to start your VB spending journey? Here’s your step-by-step action plan:

Week 1: Values Discovery

- Identify core values

- Review recent spending

- Note alignment gaps

- Set initial goals

Week 2: System Setup

- Create tracking methods

- Establish review routines

- Plan value-aligned purchases

- Remove spending triggers

Week 3-4: Practice and Refinement

- Implement daily value checks

- Adjust categories as needed

- Celebrate aligned choices

- Build support systems

Looking Forward

VB spending isn’t just a budgeting method – it’s a pathway to a more intentional and satisfying life. Start your journey today by identifying one area where you can better align your spending with your values.

Remember: The goal of value-based spending isn’t perfection, but progress toward a more meaningful relationship with money. Each aligned decision brings you closer to financial peace and life satisfaction.

Take that first step toward VB spending today. Your future self will thank you for choosing this path to financial clarity and personal fulfillment.

This article was written by a human writer using AI automation tools to segregate content, improve syntax and spelling, and present the article in a readable and understandable way.